Accountancy (224)

Tutor Marked Assignment

20% Marks Of Theory

1. Answer any one of the following questions in about 40 to 60 words.

(a) Give two examples of business and non-business transactions each.

Answer: Business Transactions:

1. Sales of Goods: A company sells merchandise worth Rs. 5,000 to a customer. This transaction increases the revenue and accounts receivable (if sold on credit) or cash (if sold for cash).

2. Payment of Expenses: A business pays Rs. 2,000 for office rent. This transaction decreases cash and increases the rent expense in the accounts, affecting the overall profit.

Non-Business Transactions:

1. Personal Withdrawal: The owner of a sole proprietorship withdraws Rs. 1,000 for personal use. This transaction decreases the owner's equity and cash but does not affect business revenue or expenses.

2. Gift Received: An individual receives a gift of Rs. 500 from a family member. This transaction does not involve business activities or financial reporting and is not recorded in the business accounts.

2. Answer any one of the following questions in about 40 to 60 words.

(a) “Whatever the business possesses in the form of assets is financed by proprietor or by outsiders.” Justify the statement giving four appropriate examples.

Answer: The statement "Whatever the business possesses in the form of assets is financed by the proprietor or by outsiders" highlights how businesses acquire assets through different funding sources. For instance, an owner may invest personal savings to buy machinery, representing owner's capital. Alternatively, a business might take a bank loan to finance a commercial property, creating a liability. Additionally, attracting investors can

provide capital for inventory and technology, showcasing external financing. Lastly, trade credit allows businesses to acquire goods while deferring payment, illustrating another form of outside financing. These examples demonstrate the diverse means of funding business assets.

3. Answer any one of the following questions in about 40 to 60 words.

(a) Explore tally with your friend and write any four features.

Answer: Here are four key features of Tally, a popular accounting software:

1. User-Friendly Interface

Tally offers an intuitive and straightforward interface that makes it easy for users, even those with minimal accounting knowledge, to navigate and perform tasks efficiently.

2. Comprehensive Accounting

Tally provides robust features for managing various accounting functions, including ledger management, invoicing, billing, and financial reporting, enabling businesses to maintain accurate financial records.

3. Inventory Management

Tally includes inventory management capabilities, allowing businesses to track stock levels, manage purchases and sales, and generate inventory reports, facilitating effective stock control.

4. GST Compliance

Tally is designed to ensure compliance with Goods and Services Tax (GST) regulations, offering features for GST calculation, filing, and reporting, making it easier for businesses to adhere to tax requirements.

These features make Tally a valuable tool for businesses seeking to streamline their accounting processes.

4. Answer any one of the following questions in about 100 to 150 words.

(b) Discuss with two employees of any two organisations and explain how accounting is useful to them.

Answer: Discussion on the Usefulness of Accounting

Employee 1: Financial Manager at a Manufacturing Company

The financial manager highlighted that accounting is vital for tracking the company’s financial health. Accurate records facilitate budgeting and forecasting, enabling effective resource allocation. Monthly financial statements help assess profitability and monitor cash flow, allowing informed decisions regarding production and investment. Additionally, precise accounting practices ensure compliance with tax regulations, minimizing the risk of penalties.

Employee 2: Sales Executive at a Retail Firm

The sales executive explained that accounting aids in understanding sales performance and managing inventory. Regular sales reports help identify trends, set sales targets, and adjust strategies accordingly. Knowledge of

inventory levels, provided by accounting, ensures efficient stock management, preventing overstocking or stockouts. Furthermore, insights into customer payment patterns assist in managing accounts receivable, which is crucial for maintaining healthy cash flow.

In both organizations, accounting is essential for financial management, decision-making, and operational efficiency, demonstrating its importance across various functions.

5. Answer any one of the following questions in about 100 to 150 words.

(a) (i) If a firm borrows a sum of money, what will be its effect on the Accounting Equation?

(ii) Give two examples– one showing the effect only on assets and the other on liabilities only.

Answer: (i) If a firm borrows a sum of money, what will be its effect on the Accounting Equation?

When a firm borrows a sum of money, it affects the accounting equation, which states:

Assets = Liabilities + Owner's Equity

Effect of Borrowing on the Accounting Equation

1. Increase in Assets: The firm receives cash or other assets when it borrows money.

2. Increase in Liabilities: The borrowed amount is recorded as a liability (e.g., loan payable).

Example

Scenario: A company borrows Rs. 50,000 from a bank.

- Assets: Cash increases by Rs. 50,000.

- Liabilities: Loan Payable increases by Rs. 50,000.

Accounting Equation Before Borrowing:

- Assets: Rs. 100,000

- Liabilities: Rs. 60,000

- Owner's Equity: Rs. 40,000

Accounting Equation After Borrowing:

- Assets: Rs. 100,000 + Rs. 50,000 = Rs. 150,000

- Liabilities: Rs. 60,000 + Rs. 50,000 = Rs. 110,000

- Owner's Equity: Remains at Rs. 40,000

Final Equation:

Assets (Rs. 150,000) = Liabilities (Rs. 110,000) + Owner's Equity (Rs. 40,000)

The accounting equation remains balanced, illustrating that the increase in assets and liabilities is equal.

6. Prepare any one project out of the following.

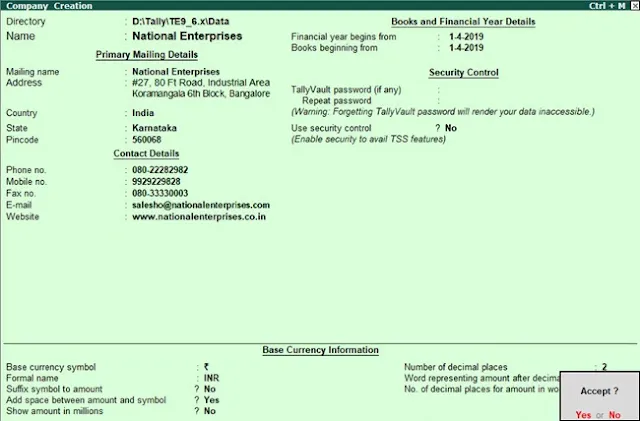

(b) Discuss with your friend write the hardware requirement and important steps to open a Tally software. Create a company on Tally ERP9.0. and attach print outs of the screenshots of the Company created.

Answer:

Project Work

Objective

To understand the hardware requirements for Tally ERP 9 and to learn the steps involved in opening the software and creating a company.

Hardware Requirements for Tally ERP 9

To effectively run Tally ERP 9, the following hardware specifications are recommended:

1. Processor: Intel Core i3 or equivalent (minimum)

2. RAM: 4 GB (8 GB or more recommended for better performance)

3. Hard Disk: 1 GB of free space (more is recommended for larger data)

4. Display: 1024 x 768 resolution or higher

5. Operating System: Windows 7 or later (32-bit or 64-bit)

6. Network: Internet connection for updates and remote access (if needed)

Important Steps to Open Tally ERP 9 and Create a Company

1. Install Tally ERP 9:

- Download the installation file from the official Tally website.

- Run the installer and follow the on-screen instructions to install.

2. Launch Tally ERP 9:

- Double-click the Tally icon on your desktop or start menu to open the application.

3. Select Company Option:

- On the Tally welcome screen, choose "Create Company."

4. Enter Company Details:

Fill in the required fields:

- Company Name: Enter the name of your company.

- Address: Provide the company address.

- Country: Select the country.

- State: Choose the state.

- PIN Code: Enter the postal code.

- Financial Year: Set the starting date of the financial year.

- Books Beginning From: Set the date from which the books of accounts will be maintained.

5. Set Security Features (Optional):

- You can set a security control feature if needed.

6. Save the Company:

- After entering all the details, click "Save" to create the company.

7. View the Company:

- You can now select the company from the list to start using Tally for accounting.

Printouts and Screenshots

Conclusion:

By following these steps, we can successfully set up Tally ERP 9 and create a company. Make sure to familiarize yourself with the features and functionalities of Tally for effective accounting management.

%20EM%20Solved%20TMA%202024-25.webp)